The question of whether to take out private health insurance is a fiercely personal one. Currently, Australians are divided evenly on the matter with 1 in 2 covered by private health insurance. But with those privately insured slipping to an 11 year low, many are signalling that if an intervention isn’t made soon, the private healthcare system could slip into a death spiral. With all this talk of doomsday events, and so much confusion about whether private insurance is necessary or not, we decided to do a deep dive to get a clearer understanding of the issues at hand.

How did we get here?

In order to gain an understanding of today’s public vs private landscape, we must revisit the critical milestones that led us to this point. In her article, “The multi-billion-dollar subsidy for private health insurance isn’t worth it,” Elizabeth Savage, a Professor of Health Economics at the University of Technology Sydney, identifies the following landmark events:

- The public health system, Medicare, was introduced in 1984. By 1998, private health coverage had fallen to 30% of the population compared to 50% in 1985.

- In 1997, fearing that this trend was a “spiral that would put unbearable pressure on public hospitals,” the Medicare Levy Surcharge was introduced by the Howard Government. This meant higher income earners without private cover had to pay 1% of taxable income as part of the surcharge.

- In 1999, the surcharge was accompanied by a 30% premium subsidy for those already privately insured and new entrants to the private system.

- In 2001, the Lifetime Health Cover (LHC) policy was introduced. This was a financial loading that increased by 2% for each year the cover owner was older than 30. It was payable in addition to the base rate premium for any private health insurance hospital cover. Those who purchased before the strict deadline of July 1, 2000, avoided the age loading irrespective of their age at entry. After the deadline, only those aged 30 or younger could avoid the loading.

This is where the groundbreaking ‘Run For Cover’ campaign came into play.

What was the ‘Run for Cover’ campaign?

In anticipation of the July 1, 2000, deadline, the government funded an advertising blitz across print and electronic media, known as the ‘Run for Cover’ campaign.

“The campaign results were staggering. In the lead up to the deadline, the proportion of people with hospital insurance leapt from 31% to 45%.”

According to Lesley Russell, adjunct Associate Professor at the Menzies Centre for Health Policy at the University of Sydney, the reasoning behind the uptick was more emotional rather than sound financial reasoning.

Russell said of the campaign, “It’s an enticement that’s not evidence-based to persuade people to buy a product that they don’t really want and perhaps don’t even really need.”

The article ‘Run for Cover Now or Later?’ published by Springer Online offers a comprehensive deep dive on the fallout from the campaign. The article looks at whether the combined financial implications of the Medicare Levy Surcharge, 30% premium subsidy, and the LHC resulted in more privately insured Australians, or whether the campaign and hard deadline played more of a role.

The authors of the article, Randall P. Ellis and Elizabeth Savage, conclude that “the ‘Run for Cover’ advertising campaign had a significant impact independently of price threats” and that “the deadline appeared to induce consumers to enrol now rather than delay.”

Ultimately, the campaign illustrated how effective scare tactics and strict deadlines can be at influencing public behaviour.

Where are we at now?

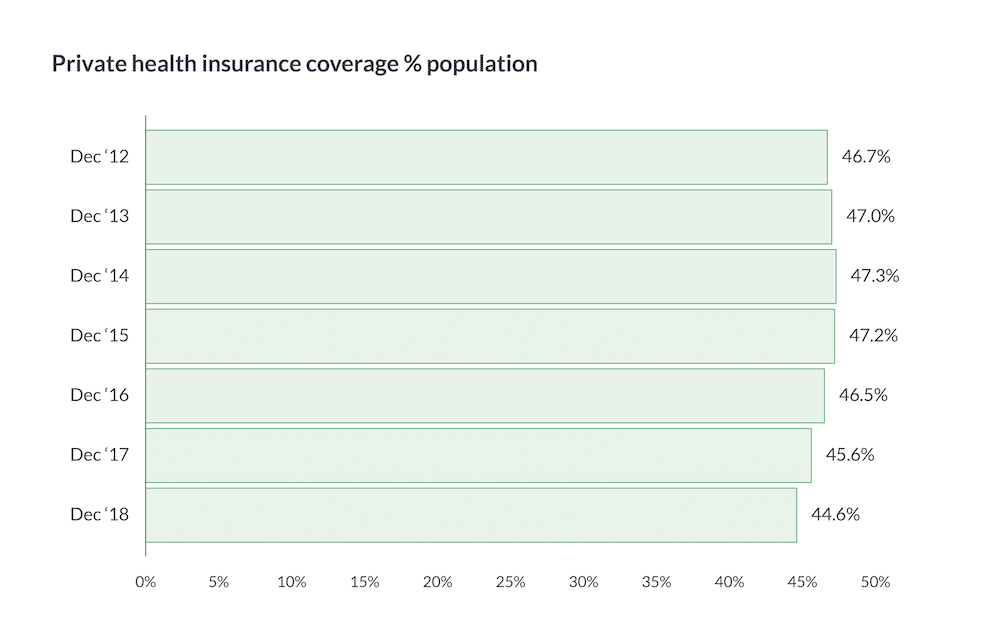

Private health insurance coverage recently reached an 11 year low. According to a recent APRA publication only 44.6% of Australians are privately covered.

While the figures show that Aussies are abandoning their cover, Australian Private Hospitals Association (APHA) CEO, Michael Roff, says that those who have kept their coverage are using it at an increasing rate, as episodes of care in private hospitals saw an uptick of 1.6% in the December quarter.

“While it’s disappointing to see participation in private health insurance drop, we know it’s not because Australians see low value in private hospital care. Australians recognise the importance of being able to access care when they need it, with the doctor of their choice and the high quality of care provided in the private system,” Roff said in a statement.

However, there is data to suggest that Australians are losing confidence in the private system. In 2018, Roy Morgan researchers conducted face-to-face interviews with more than 50,000 Australians over a 12-month period, and the results were largely damning for private insurers:

- When compared to the same period in 2014, those who agreed with the statement “It is essential to have private health insurance” declined by 10% to 56.2%

- The next largest change was an increase of 7.7% in people who agreed with the statement “It is difficult to understand what you are actually covered for with private health insurance”, which rose to 43.7%

- The proportion of people who agreed “Extras and hospital cover are equally important” fell 7.1% to 54.1%

- Only 70% of the survey participants who said they have private health insurance agreed “Above all else, private health insurance is about knowing that you will be able to cover the cost of big medical expenses if they arise” compared to 77.5% that agreed with this same statement in 2014

- Those who agreed that “Health insurance gives me peace of mind” also fell over the same period, from 74.5% to 68.1%

This Roy Morgan research also highlights the difference in attitudes across generational groups. The vast majority of pre-boomers (those born before 1946) view private health insurance as a necessity in order to mitigate the potential cost of big medical expenses, compared to roughly half of Gen Z (those aged between 14 to 27).

However, Millennials (born ’76-90) and Gen X (born ’61-75) were more likely to agree with the statements, “I want the cheapest and don’t care which provider”, “Only reason to have it is to avoid paying tax” and “I don’t see much value in having it.”

A Roy Morgan spokesman, Norman Morris, said this would be of concern to private health insurers given millennials and Gen X were target markets:

“It appears that the major decline in considering it essential to have private health insurance is likely to be a response to the lack of perceived value due to rapidly rising premiums and some uncertainty relating to what is covered,” he said.

The ramifications of young people abandoning private cover

If young and healthy people continue to abandon private health cover in droves, this will leave a larger proportion of unhealthier, older and expensive users. Such a shift will create a huge strain on private insurers, and some are suggesting we are seeing the beginning of an industry ‘death spiral’.

Some leading voices are even suggesting government intervention is required. The Grattan Institute’s Health program director, Stephen Duckett, said inevitably, the government would be faced with the question of how to manage such a crisis:

“The [government] is going to have to step in sometime, probably in the next 18 months or so, and it’s going to have to confront the issue about its very policies, its red tape, needs to be addressed and how is it going to do that, and what is the future of the industry,” he said.

“Just supporting the private health insurance rebate is not enough, the industry needs reform, it needs reform in terms of the way it’s regulated, it needs reform in the way the various parts of the industry react to each other.”

Crunching the numbers

The ABC have developed a useful interactive tool that allows users to estimate how much their annual private insurance premium would be, using the following three tiers:

- Basic: Lots of restrictions and exclusions, including for heart procedures, plastic surgery, mental health services and palliative care

- Medium: Includes things not in basic cover; restrictions / exclusions include pregnancy and birth services, IVF, cataracts and hip replacements

- Top: No exclusions and restrictions, covers all services where Medicare pays a benefit

Average Annual Private Health Insurance Cost for Singles

| Basic | Medium | Top | |

| 0 dependent children | $1,336 | $1,711 | $1,872 |

| 1 or more dependent children | $2,245 | $2,843 | $3,295 |

Average Annual Private Health Insurance Cost for Couples

| Basic | Medium | Top | |

| 0 dependent children | $2,602 | $3,423 | $3,738 |

| 1 or more dependent children | $2,715 | $3,423 | $3,747 |

But it’s not that simple. The above figures are simply ballpark estimates, and the actual costs are influenced by the following factors:

Taxable Income

Singles earning under $90K annually, and couples with a household income under $180K annually, will not have to pay the Medicare Levy Surcharge penalty. Australians earning more than these amounts will have to pay the levy, which starts at 1% of your annual income and the percentage increases from there.

“But few 30 to 39 year olds, a group that insurance providers are desperate to target, earn enough to be affected by this penalty. The latest Census data showed that 80% in this age bracket earn less than $90,000 a year.”

Takeaway: high-income earners should strongly consider opting into the private system otherwise you will be pinged by the government, but this doesn’t affect that many young Australians, as they are earning far less than older generations.

Location

There are also some differences depending on where you live. For example, in some states a trip in an ambulance is already free — it’s covered by their state government. But in other states, a typical trip in an ambulance can cost $600 to $1,200. Plus, there are differences in public waiting times for certain procedures across the country, therefore this could have serious ramifications in the event of a serious accident or emergency.

Takeaway: where you live will impact how confident you should feel in the public system.

Age

The government also offers a rebate to make your insurance premiums cheaper. The younger you are, the lower your government rebate will be. Your rebate is usually paid in the form of a lower premium from your insurance provider.

Plus, there is the Lifetime Health Cover loading to consider, which is all about trying to get Australians to sign up for private health coverage at the age of 30.

“Anyone who does not have hospital cover on July 1 after their 31st birthday pays an extra 2% for insurance for every year over age 30, if and when they sign up for insurance, capped at 70%. The penalty disappears after paying for 10 years.

Source: Canstar

Takeaway: those over 30 are incentivised to take out private cover (and penalised for not having cover) compared to those under 30.

In order to gain a more detailed understanding on your individual situation you can complete the interactive tool online.

Conclusion

Taking a step back, it’s clear that when Australians ask the question, ‘Do I really need private health insurance?’, the critical factors that influence their decision all revolve around risk tolerance and value for money.

For instance, in an interview with the ABC, Nathan Wood, a 33 year old who works in the music industry, lamented his recent experience with the private system. Nathan had basic coverage but still had to pay more than $1,000 in out-of-pocket costs for day surgery.

He shared, “I had a procedure done and was talking to one of the nurses when I went in and she asked if I had health insurance, and I said I did, but I had a basic package and it didn’t seem to cover anything.

“She [the nurse] said, ‘We find that quite a lot actually and we usually just mention to young people that it’s probably not worth it a lot of the time’. [I was] pretty surprised to hear that from a healthcare worker.”

“If it [private health insurance] comes up in conversation, I pretty much refer to it as a waste of money,” Nathan explains.

This is not to say it’s a waste of money for all. There are many, particularly older individuals who are in and out of hospital often, and who have top level coverage, who cite getting a lot of value out of private health insurance.

The catch is that Gen Y and Gen Z Australians have far more risk tolerance when it comes to staying within the public system for as long as possible. Which is a problem with the current setup because they often don’t see the value until after the age of 30, and by this point, they are hit with such large penalties that they choose to never get onboard.

Considering this, and how Australia’s ageing population is continuing to rely heavily on both the public and private sectors, the private system is likely to feel greater and greater strain.

It’s not inconceivable to think that if things keep going the way they’re going, the government may need to consider further incentives to push more young people into the private system.

Perhaps, we’ll see this push in the form of another emotionally-charged blitz rolled out across all the big media channels with a threatening deadline akin to 2000’s ‘Run for Cover’ campaign.

What are your thoughts?

Share your opinion and continue the conversation at For the Love of Healthcare.