Watch the Webinar

Download

Links to Resources

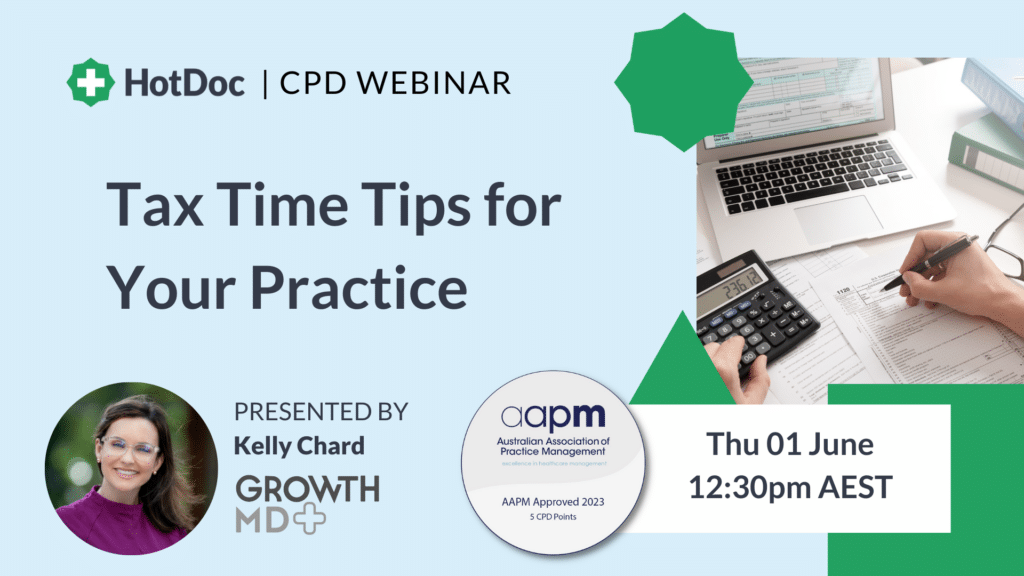

Session = 1 CPD hour

This session covers:

- New tax breaks for your business in 2023 including the small business technology boost, the small business training boost, and asset write offs

- How you can use electric vehicles as a tax effective retention tool for your team members

- An end of financial year checklist to help you tick off the important “to-dos” leading up to 30 June 2023 and position your practice for a successful year end

- Q&A with Kelly Chard

About the Presenter

Kelly Chard

Founder, GrowthMD

About Kelly Chard:

Throughout her 20-year accounting career, Kelly has partnered with a diverse client base including ASX listed companies, multi-site clinic groups and small start-up businesses. Kelly’s everyday approach to business is simple – focusing on leveraging technology, valuing personal relationships, and finding practical solutions. Kelly’s professional qualifications include:

- Fellow, Chartered Accountants Australia and New Zealand

- Fellow, Taxation Institute of Australia

- Registered Taxation Agent

- Member, Australian Company Directors

About GrowthMD:

GrowthMD partners with clients all over Australia in providing smart, actionable advice for business challenges and opportunities unique to medical practices. GrowthMD clients receive:

- Accounting and Taxation Compliance Services

- Practice Valuation Services

- Benchmarking and Business Insights

- Bookkeeping and CFO Services

- Structure Reviews and Establishment

- Practice Buy and Sell Advice

Learn more at www.growth-md.com

Have a question about this webinar? Visit Webinar FAQs here